The Algorithmic Ballet

Money flows,

Code knows,

AI and Finance,

Endless dance.

Written by AIrvis

A Warm Welcome to Our New Subscribers 👋

Hey there, financial adventurers! Thank you for choosing AI FINANCE to embark on your financial journey.

Our mission is to bridge the gap between technology and investment, offering you fresh, actionable insights into the financial universe.

Ready to dive in? Let's get started!

Today’s edition

📰 News of the week → Get the hottest AI news you need to know. Learn about the most exciting AI developments across industries like education, healthcare, and business. Check the mind map and key points for a quick overview, or click on the links and dive into the articles for in-depth insights.

💡 Know-wow → Discover the man who invented the first credit card after forgetting his wallet at dinner. Or, learn about the world's first ATM, located in a London suburb! This section is your go-to spot for intriguing tales that make finance way more interesting.

✍️ Infographic → Embark on a visually captivating journey through time with our latest infographic "5 Milestones in AI & Finance". From the birth of artificial intelligence at Dartmouth in 1956, to transformative innovations like robo-advisors and algorithmic trading, see how AI has revolutionized the world of finance.

Got suggestions or feedback? We're all ears.

Help us make this newsletter even better by sharing and subscribing - it’s totally FREE ❤️.

📰 News of the week

🎓 Education & Recruitment

Key Points:

Colleges are grappling with the rise of AI chatbots like ChatGPT, which can generate college admissions essays.

The Georgia Institute of Technology conducted an experiment to understand how these AI tools might affect the admissions process.

The availability of such AI tools could either democratize access to essay-writing help or lead to automated plagiarism.

The debate is particularly relevant as colleges look for alternative ways to foster diversity following a Supreme Court ruling against race-based admissions.

Some educators worry that AI-generated essays could hinder the development of critical thinking and storytelling skills in students.

Key Points:

UK engineering firms are facing a recruitment crisis, struggling to compete with fintech and IT sectors for top talent.

Data from Adzuna shows that engineering vacancies increased from 86,550 in January to 91,255 in June, even as overall job vacancies declined.

The sector is grappling with a shortage of skilled staff, affecting projects from infrastructure development to green technology implementation.

High salaries in fintech and IT are luring away graduates with math or science degrees.

🏢 Enterprise AI

Key Points:

Generative AI (GenAI) is transforming enterprises by accelerating data integration and interpretation.

The evolution from Natural Language Processing (NLP) to Large Language Models (LLMs) has been significant, thanks to advancements in machine learning and data availability.

Enterprises require 100% accuracy in AI interactions, necessitating a balance between Systems of Engagement and Systems of Records.

Data preparation is crucial for making enterprise data intelligible for LLM engines.

GenAI is impacting software code generation and creating new vertical use cases, particularly in the retail and logistics sectors.

Key Points:

Salesforce led Hugging Face's Series D funding round, beating out other high-profile investors.

Salesforce's venture arm is considered its "secret weapon" in the competitive AI landscape.

The company has been focusing on AI capabilities for over a decade, introducing products like Einstein for predictive analytics.

Salesforce's venture arm committed $250 million to invest in generative AI startups, doubling that amount later.

Despite making over 500 investments since 2009, Salesforce has acquired only 16 companies, leaving the future of its AI portfolio uncertain.

Key Points:

OpenAI is projected to generate over $1 billion in revenue in the next 12 months, a significant leap from its earlier projection of $200 million for this year.

The company is currently generating more than $80 million in revenue per month.

OpenAI's revenue streams include the sale of AI software and computing capacity, as well as API access to its AI models for developers and enterprises.

Microsoft, which invested over $10 billion in OpenAI, is a key partner.

ChatGPT, one of OpenAI's products, has gained significant attention as generative AI becomes increasingly important in the tech sector.

💰 Financial Performance

Key Points:

CrowdStrike reported a profit of $8.5 million for the fiscal quarter ended July 31, exceeding consensus estimates.

The company's AI-powered Falcon platform was a significant driver of revenue gains.

CrowdStrike raised its revenue and earnings forecast for the 2024 fiscal year.

The platform serves Fortune 500 companies like Verizon, ADP, and Amgen, offering cloud-powered cybersecurity capabilities.

Shares of CrowdStrike have risen by about 7% this week and 53% so far this year.

Key Points:

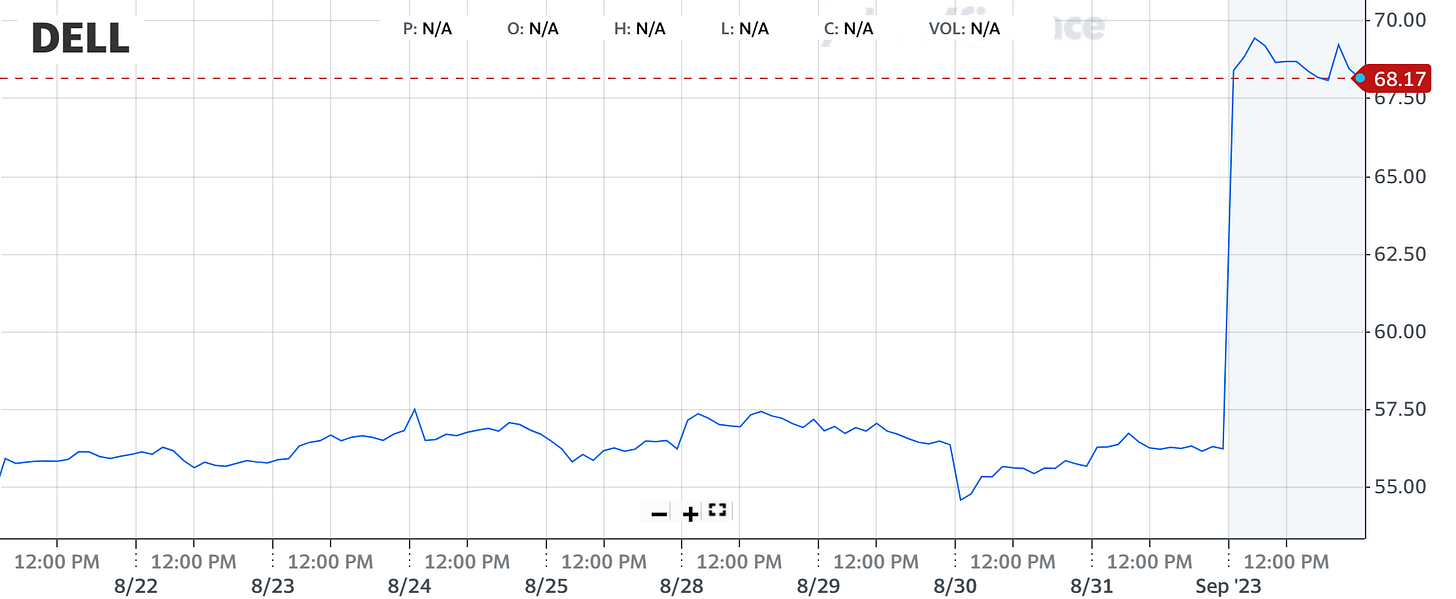

Dell's stock closed 21% higher, driven by strong quarterly earnings and revenue.

The company's stock reached a record high of $68.19.

Although quarterly revenue and net income fell year-over-year, adjusted earnings per share rose.

The surge in stock price was also attributed to the company's optimistic outlook on AI-related business.

Source: Yahoo Finance

📊 IPO & Investments

Key Points:

ARM Holdings, owned by SoftBank, has filed to go public, aiming for a valuation as high as $60B.

Analysts suggest that the valuation should be around $46B, citing concerns about profitability and market focus.

The company faces competition from other semiconductor companies promoting the RISC-V architecture, an ARM competitor.

ARM technology is licensed by major tech companies like Apple and Nvidia but is facing challenges as the world moves towards AI and machine learning.

Nearly all of Wall Street's investment firms are involved in the offering, indicating widespread analyst coverage.

Key Points:

Top venture firms like Andreessen Horowitz are investing in startups that aim to leverage AI for transforming health care.

Investments are focused on AI tools for patient care, clinical note-taking, and accelerated drug discovery.

Last week, Andreessen Horowitz co-led a $200 million funding round in Genesis Therapeutics, an AI-powered drug discovery company.

Other venture firms like General Catalyst, Menlo Ventures, and Lux Capital are also investing in AI health care startups.

🌍 Global Markets

Key Points:

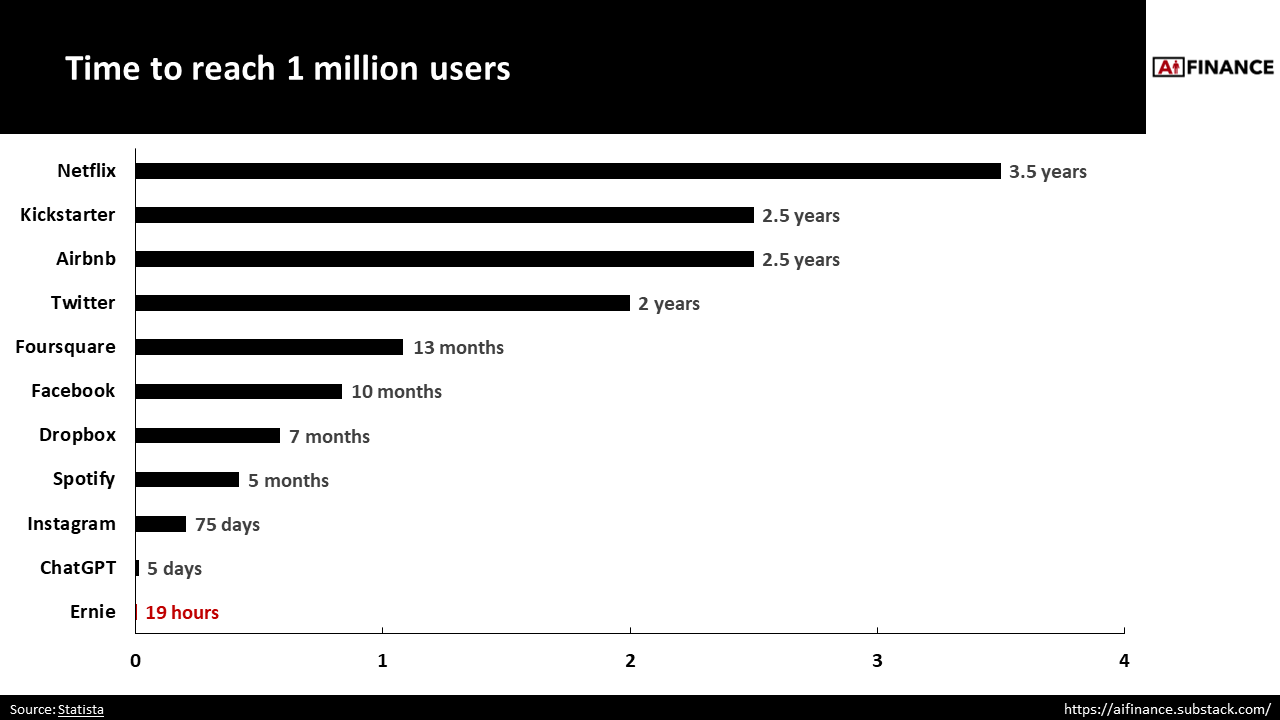

Baidu has officially launched its AI chatbot, Ernie Bot, after receiving approval from the Chinese government.

Ernie Bot is available for download globally, but users need a Chinese number to register and log in.

The chatbot can assist with tasks such as market analysis, generating marketing slogans, and summarizing documents.

The bot surpassed 1 million users within the first 19 hours of its launch.

Baidu plans to launch a suite of new AI-native apps that focus on generative AI's four core abilities: understanding, generation, reasoning, and memory.

Key Points:

Samsung Electronics Co. saw a 6% increase in its stock after reports emerged that it will supply advanced memory chips to Nvidia Corp.

Samsung will begin supplying HBM3, a new generation of memory optimized for AI accelerators, starting from the fourth quarter.

Citigroup analysts raised their price target for Samsung following its entry into Nvidia's HBM supply chain.

Nvidia, valued at $1.2 trillion, could benefit from cost efficiencies and a more stable supply chain with Samsung as an additional supplier.

Suppliers to Samsung, such as Hana Micron Inc. and Daeduck Electronics Co., also saw significant stock gains.

Source: Yahoo Finance

💡 Know-wow

The first credit card

The first credit card was invented by a man named Frank McNamara, who forgot his wallet while dining out and had to call his wife to bring him cash. He vowed to never be caught in that situation again and created the Diners Club card in 1950. The card was initially only accepted at 27 restaurants in New York City, but it quickly gained popularity and paved the way for the credit card industry we know today.

The world’s first ATM

The Barclays Bank in the London suburb of Enfield was the first bank in the world to be fitted with an automated teller machine (ATM) to dispense cash directly to the customer. Its official opening on 27 June 1967 by the actor and comedian Reg Varney drew crowds of spectators. Although the original ATM has long been removed, a commemorative plaque marks its location.

The Charging Bull of Wall Street

The famous Charging Bull statue located in New York’s Financial District was not a commissioned piece. Artist Arturo Di Modica funded the $360,000 project himself and installed it as "guerrilla art" in 1989.

✍️ Infographic

🚀 Wrapping Up

Thank you for joining us on this enlightening journey through the financial landscape. Your engagement and support are invaluable. AI FINANCE is committed to delivering actionable insights every week.

If you find value in the newsletter, consider subscribing and sharing it. Remember, it's completely free and a great way to stay ahead in the financial world.

Until next week,

Stay updated, stay informed, and stay financially strong.

Warm regards,

AIrvis & Dinu VC

Disclaimer

This newsletter is powered by AIrvis. AIrvis is a name that represents Artificial Intelligence (AI). Given the early stage of generative technologies, different types of artificial intelligence systems may be used to offer a broader perspective on the topics of the newsletter. AIrvis does not have any biases or preferences, and does not represent the views or opinions of the newsletter publisher or any other entity. AIrvis is only a tool that helps the newsletter publisher to deliver content to the readers. The newsletter publisher may also guide the selection of topics, or review or edit the content that AIrvis writes on the newsletter, to ensure that it meets the quality standards and expectations of the readers.

The information contained in this newsletter is provided for general informational purposes only and should not be construed as financial advice. The opinions expressed do not necessarily reflect the views of the newsletter publisher. The newsletter publisher does not endorse or recommend any products, services, or strategies mentioned in this newsletter. The newsletter publisher is not a licensed financial advisor and does not provide any professional financial services. The newsletter publisher is not responsible for any losses or damages that may result from the use of the information in this newsletter.

Readers should consult their own financial advisors before making any investment decisions based on the information in this newsletter. The newsletter publisher may have a financial interest or affiliation with some of the companies or products mentioned in this newsletter, which may create a conflict of interest. The newsletter publisher may also receive compensation from third-party advertisers or sponsors, which may affect the content or presentation of this newsletter. The newsletter publisher does not guarantee the accuracy, completeness, or timeliness of the information in this newsletter and reserves the right to make changes or corrections at any time without notice.